Payments in foreign currencies when travelling and online

September 15, 2021Payments in foreign currencies. Not everyone has several accounts with different currencies and a credit card to go with them. Even if you do you don't want to use many cards. At the same time you travel a lot and there are always many currencies. How to effectively deal with payments in foreign currencies on the Internet and when traveling is covered in this article.

Customs and Payments

When traveling, one deals with various problems. As I'm no longer tied to one workplace, I travel a lot more and even abroad. One of the things that one then solves is how to pay abroad so mainly how to pay in foreign currency. The traditional practice of the previous generation was to calculate the expenses before leaving and exchange the amount for cash. If you have only one destination and a precise plan hence a budget why not, after all they take cash everywhere. However, nowadays there is much less planning and more dynamic changing of plans. There is also travel to more than one country. If the Czech Republic had the euro as its currency and you only travelled in the European Union, it would be fine. However, you often travel to more distant countries and need different currencies. You can exchange cash at your destination, but it depends on what exchange office or ATM you come across. You may run into various fees or even nasty ATM fees see Zdenek Rubes. Euronet ATMs.Personally, I've paid an unnecessary withdrawal fee, had an unfavourable exchange rate, or even had money exchanged twice. So how to pay in a foreign currency that is convenient and not unnecessarily expensive?

Multiple currencies multiple cards

So the easiest way is to pay by card and card in a given currency. And for smaller expenses, maybe make one cash withdrawal at the beginning. This assumes you have multiple accounts in different currencies and different cards to go with them.

Curve card

If, like me, you don't want to carry multiple cards I recommend getting a Curve card, which allows you to change which end card to draw from using one card and switching in the mobile app. When you also link corporate cards to a given card, you can conveniently carry just one card instead of a bundle of, say, eight. What's more, the mobile app also instantly shows you an online overview of your payments so you can keep better track of your payments.

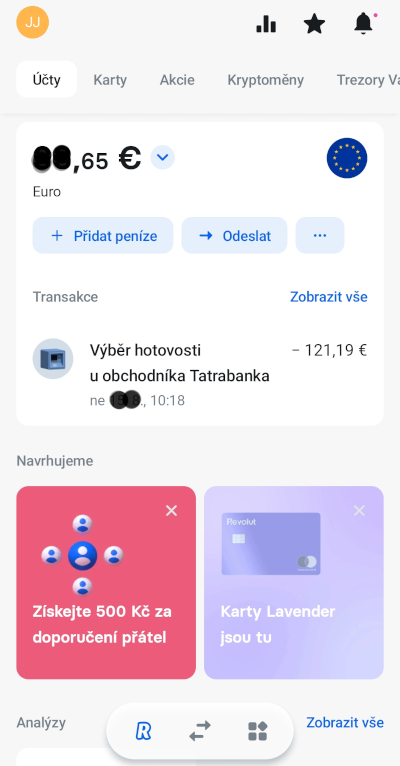

Revolut card

Revolut card supports different currencies on one card. The Revolut card also allows for a more favorable exchange rate. Typical usage is that you charge the card first and then exchange the money into the currency of the country you are in as needed.

I've used the Revolut card in Slovakia, Poland, Austria and during nomadic stays in Las Palmas in the Canary Islands.

Uses

You can charge your card by paying with another card or by bank transfer. Charging by card payment is of course the fastest.

Money transfer

You can conveniently use the card instead of an exchange office or ATM withdrawal at a very favourable exchange rate.

Do it whenever you want and very quickly. You don't have to search for an exchange office or ATM and take the risk to see if they are decent.

You can also use the card as a mere money changer,. You send money there and after a convenient exchange, you send the money in the new currency to your bank account.

Payments

You can make payments with your Revolut card online, at a terminal or have a cash withdrawal at an ATM, always in the currency of the country, you just need to have a sufficient amount of that currency on the card.-

The process is typically as follows:

- On Revolut you transfer money in the currency you have (CZK for us).

- You will convert your money to Euros in the mobile app on weekdays. This gives you euros or another currency at a favourable exchange rate. Do not charge EUR from your CZK card , because then your bank will do the exchange, which is not optimal!

- You can then deal with the given amount of EUR as normal as with any other card. Or transfer the money to your account.

Terms and Conditions

It's a good idea to study the Revolut terms and conditions!

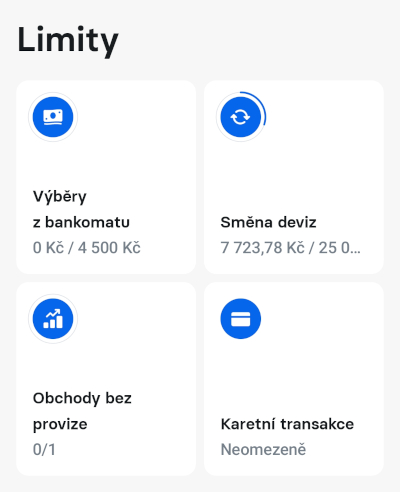

You can exchange a certain amount of money per month without a fee - 25tiskč

4500kč can be withdrawn free of charge at the ATM

Limits are set for each country in its currency.

They do not charge a fee for currency exchange on weekdays (from Sunday 17:00 EST to Friday 16:00 EST) (except for non-standard currencies).

Other features

- Sending payments to other people who have Revolut

- Transaction tracking and statistics.

- Buying stocks, cryptocurrencies, etc (note cryptocurrencies are not in your wallet, but with the provider)

- Virtual card used for one-time payment.

Other nice benefits

The mobile app keeps the last known information, so even without the internet you can look at the last downloaded balance and payment history. Of course, you need internet to update. The mobile app does not need fast data flow, so it works even where there is poor Internet e.g. only EDGE.

Electronic payments are a convenience

Personally, I prefer to be paid in cash. After all, we don't have to have everything digital and moreover managed by central organisations, but these cards are so convenient that I use them when I travel. Otherwise, I see a future in decentralized currencies like Bitcoin etc.. I also add links to cryptocurrency exchanges: Bit.plus, Coinbase, Coinmate.

The links to the services in question are affiliate links, so by purchasing the service through that link you are also supporting me.

When you want to transfer larger amounts at a favorable rate use: https://www.europlatba.cz/ https://www.citfin.cz/ https://www.roklen.cz/ and more.

Articles on a similar topic

Nomadism in Thailand in Pattaya

Visit to Poznan

Excursion to Athens and a catamaran cruise

Germany, Sazko, Dresden

Travel: camping and nomadism

Nomadism in Wroclaw

Nomadism in Las Palmas

How to start travelling. Where to get time and money?

Newsletter

If you are interested in receiving occasional news by email.

You can register by filling in your email

news subscription.

+